Decoding Tanssi II: Outsourcing Ethereum Economic Security for Appchains via Symbiotic

- Stefan Sopic

- Jul 17, 2025

- 4 min read

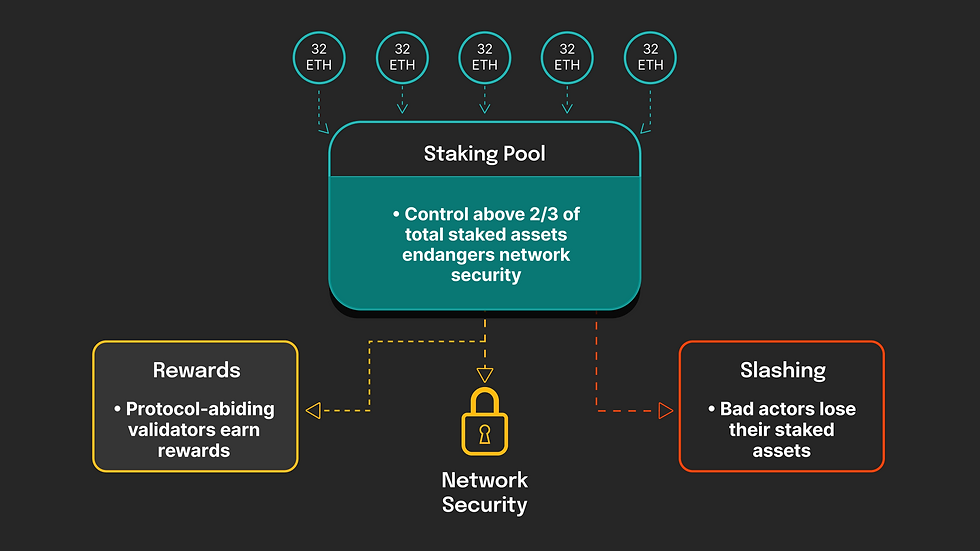

This post introduces and explains a key design challenge addressed in Tanssi, a standalone blockchain providing secure, decentralized infrastructure for appchains. A fundamental part of blockchain security involves preventing malicious actors from subverting consensus. Tanssi employs a Proof-of-Stake (PoS) consensus variant, where validators secure the network by locking assets (staking). These locked stakes provide economic security: validators who misbehave risk losing their stakes through slashing, while honest validators earn rewards proportional to their contribution.

The overall security of any PoS network fundamentally relies on attracting a sufficiently large economic stake. Typically, any entity controlling more than two-thirds of the total stake could compromise consensus. Consequently, creating compelling incentives for stakeholders to lock assets becomes critical.

The Challenge of Bootstrapping Economic Security

Attracting sufficient stake to secure a new appchain from scratch presents significant difficulties. It requires substantial effort to design compelling incentive structures, market the protocol, and attract high-quality validators. Historically, new chains initially adopt semi-centralized approaches—often relying on permissioned validators to bootstrap their networks—since achieving desired levels of decentralization and economic security takes considerable time.

Tanssi faced this common challenge as well. Rather than bootstrapping economic security from scratch, Tanssi integrates with Ethereum-based staking systems that already attract significant capital and operator participation.

Universal Staking: Leveraging Ethereum’s Validator Pool

Ethereum staking systems enable validators to extend their staked assets to secure additional services and secure multiple networks simultaneously. This method enhances capital efficiency and leverages Ethereum’s established decentralized security. By reusing Ethereum-based collateral, new appchains can inherit economic security without needing to bootstrap their own validator sets independently.

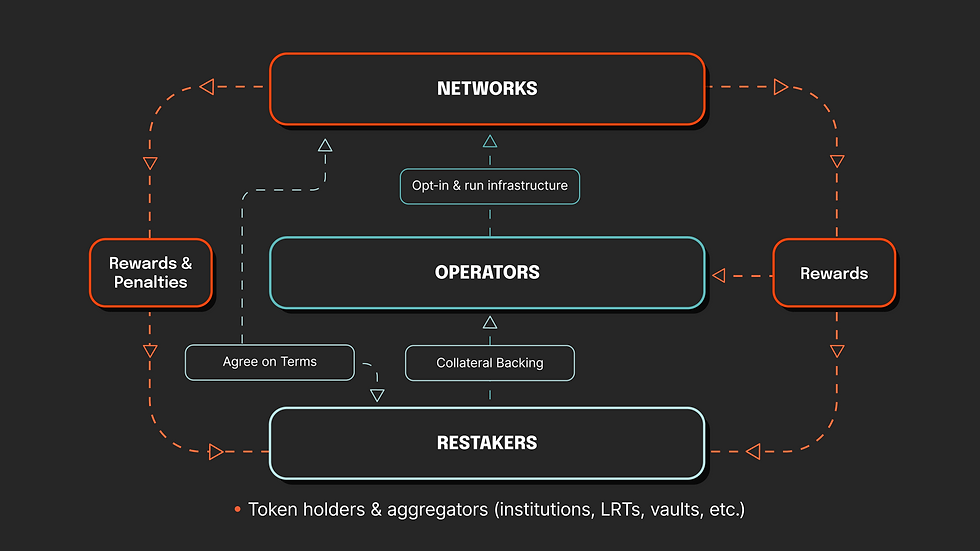

Tanssi integrates with Symbiotic, a flexible Ethereum staking coordination layer. Symbiotic enables universal staking, allowing ETH and liquid staking tokens—such as stETH and rtETH—to secure multiple networks simultaneously.

Decoupling Economic Security from Consensus: Key Design Considerations

Integrating Symbiotic’s Ethereum-based staking layer decouples two critical functionalities:

Consensus logic, maintained within the Tanssi blockchain itself.

Economic security, anchored externally within Ethereum via Symbiotic’s staking infrastructure.

This separation introduces specific technical requirements:

Continuous Cross-Chain Communication: Both Tanssi and Ethereum chains must regularly exchange crucial information to remain synchronized.

Protocol-Defined Slashing Conditions: Any slashing events defined within Tanssi must be communicated and enforced on Ethereum before a validator can withdraw their stake.

Reward Distribution Mechanics:

Because stakes are managed on Ethereum, validator rewards must also be distributed there to avoid imposing unnecessary complexity on validators.

Reliable, verifiable message-passing between Tanssi and Ethereum is essential. Tanssi achieves this using a dual light-client setup, with:

A Tanssi light-client deployed on Ethereum, verifying messages from Tanssi.

An Ethereum light-client deployed on Tanssi, verifying messages from Ethereum.

Independent third-party relayers forwarding verified messages between chains.

Core information flows are:

Ethereum → Tanssi: Validator sets, valid within specific periods.

Tanssi → Ethereum: Validator rewards and slashes.

Synchronizing Across Ecosystems: Eras and Epochs

Effective synchronization between Tanssi and Symbiotic requires clearly defined timing parameters:

Tanssi Eras: Tanssi regularly accumulates validator rewards and slashes within defined periods, known as eras. At the conclusion of each era, this information is transmitted to the Ethereum network.

Network Epochs (Symbiotic): Symbiotic uses network epochs as timeframes for snapshotting validator stakes. Stake values at the epoch start are referenced throughout that epoch. New stakes deposited after the epoch start only become effective in subsequent epochs.

Vault Epochs (Symbiotic Vaults): Defined by individual Symbiotic staking vaults, these are minimum withdrawal waiting periods (typically 5-7 days). Tanssi’s eras must always be significantly shorter than the shortest vault epoch. This ensures sufficient time to enforce slashes before validators withdraw stakes.

Two critical implications follow:

Tanssi eras must be shorter than vault epochs to reliably enforce slashing conditions.

Any stake marked for withdrawal at the start of a network epoch is excluded from validation for that epoch.

Validator Activation in Tanssi

Validator sets are communicated from Ethereum to Tanssi at each network epoch boundary. These sets become active in the subsequent Tanssi era. Stake values are frozen at epoch initiation, ensuring clear validator assignments and predictable rewards.

This allows us to set the network epoch identifier together with the operators to Tanssi. The command looks simply as we portray it below, where we receive the list of validators as a dynamically-sized vector or vec and the external_index which indicates the network-epoch

ReceiveValidators {

validators: Vec<<T as pallet_external_validators::Config>::ValidatorId>,

external_index: u64,

},Validator sets are stored within Tanssi’s runtime pallet called pallet-external-validators. Validators become active and begin participating in sequencing in the era following their initial registration.

Reward Distribution Protocol

During each era, validators perform essential infrastructure tasks, including:

Sequencing transactions on Tanssi.

Verifying sequencing integrity across connected appchains.

Validators earn points for these actions. At the end of each era, total rewards are calculated based on accumulated points and predefined inflation rates. These rewards are not distributed directly on Tanssi but instead transferred to the Ethereum Sovereign Account, a custodial Ethereum address.

To minimize cross-chain costs, reward information sent from Tanssi to Ethereum is condensed:

A Merkle root summarizing individual validator points.

Total points accrued.

Total tokens minted as rewards for the era.

Associated network epoch identifier.

Validators (or their delegators) claim rewards by proving their point totals against this Merkle root on Ethereum using an intuitive web-based DApp provided by Tanssi.

Slashing Enforcement Mechanics

Slashing events are also accumulated per era, though less frequently than rewards. When slashes occur, Tanssi communicates this information directly to Ethereum’s middleware.

Validator misbehavior triggering slashing includes:

Approving invalid blocks.

Double-signing in consensus.

Extended periods of validator downtime.

Timely enforcement is critical. Stake withdrawal requests must respect vault epochs, ensuring slashing information reliably reaches Ethereum middleware before validators can reclaim their stake.

An illustrative example:

Alice requests withdrawal of 50 tokens, but is subsequently slashed 20 tokens within the vault epoch waiting period. Due to the enforced waiting period, the slash executes in time, and Alice can only withdraw 30 tokens upon completion of the epoch.

Conclusion: Secure Bootstrapping with Minimal Assumptions

This post outlined how Tanssi utilizes Symbiotic’s Ethereum-integrated staking protocol to outsource economic security efficiently. By clearly defining a minimal interface (withdrawal epochs and slashing enforcement), Tanssi maintains flexibility, compatibility, and abstraction.

Tanssi’s staking and reward pallets can thus accommodate alternative economic security solutions with similar minimal assumptions. By integrating Ethereum-based economic security via Symbiotic, Tanssi enables appchains to launch with robust decentralization from day one—without the overhead of bootstrapping their own validator sets or staking logic.

This blog post was the continuation of Decoding Tanssi I, where we broke down how Tanssi automates appchain orchestration—laying the foundation for the economic security system explored here.

Launch your own appchain → apps.tanssi.network.

Slope 2 is a high-speed 3D arcade game where you guide a rolling ball down glowing neon tracks. The challenge gets tougher as the ball speeds up, forcing you to dodge sharp turns, narrow paths, and tricky obstacles.